Email: [email protected]

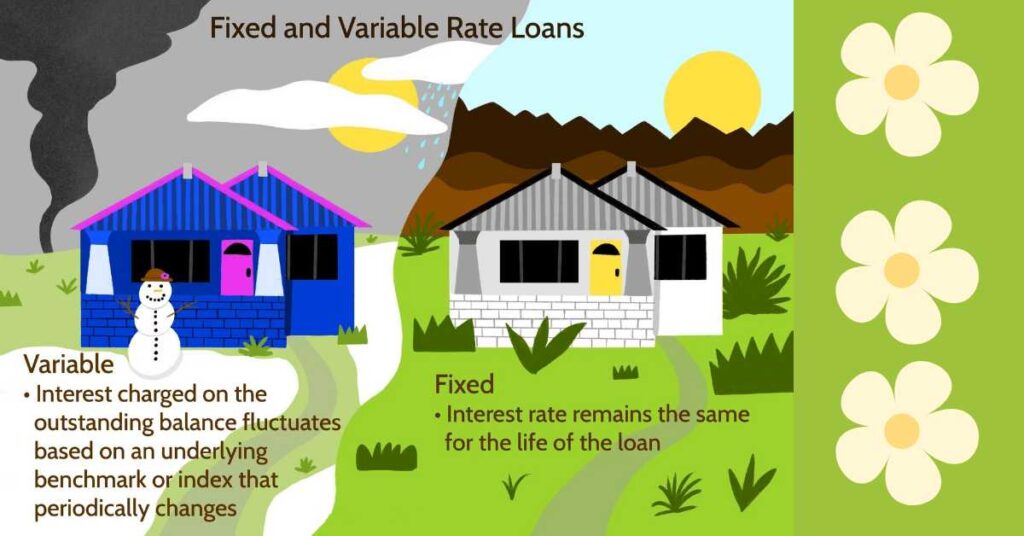

While the core concepts of fixed-rate and variable-rate mortgages remain uniform across the globe, subtle differences in mortgage product offerings, regulatory environments, and market conditions have given rise to distinct regional variations.

These variations can impact the types of mortgage products available, the terms and conditions of mortgage loans, and the overall borrowing experience.

As a result, it’s essential to understand the local mortgage landscape and product nuances when exploring financing options, ensuring that you make an informed decision that aligns with your financial goals and circumstances.

In conclusion, grasping the distinctions between fixed-rate and variable-rate mortgages empowers you to make a well-informed decision aligned with your financial circumstances and objectives.

When selecting the optimal mortgage solution, it’s crucial to consider factors such as regional market trends, credit profile, and loan specifications.

By doing so, you’ll navigate the mortgage landscape with confidence and secure a financing option that meets your unique needs.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.