Email: [email protected]

Securing financing for a property is a significant milestone, but it also involves crucial decisions that can impact your financial well-being. One of the most critical choices you’ll make is selecting between a fixed-rate loan and variable-rate loan.

This decision can have far-reaching consequences on your monthly payments, interest rates, and overall financial situation. Understanding the pros and cons of each option is vital to making an informed decision that aligns with your financial goals and risk tolerance.

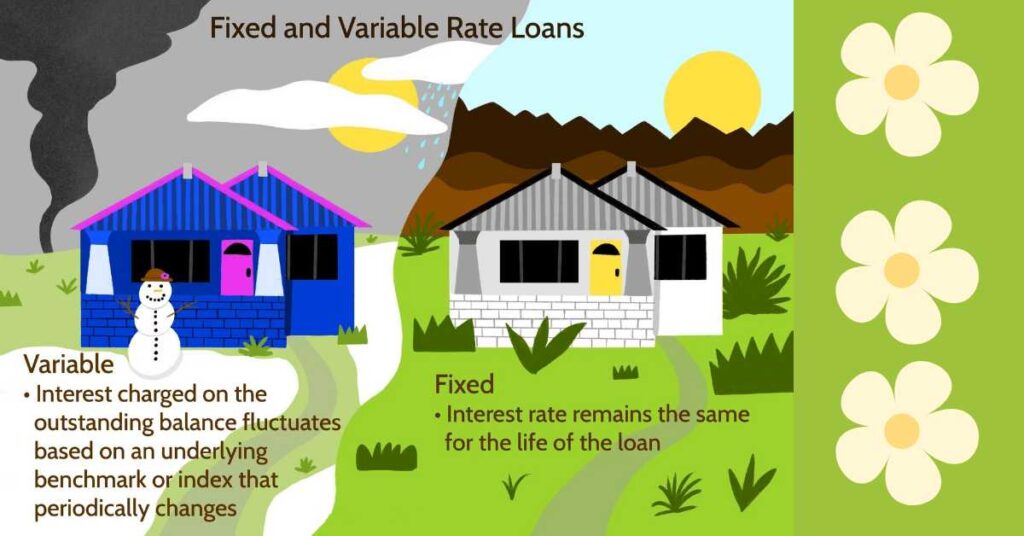

With various financing options available, from conventional fixed-rate loans to adjustable-rate loans, it’s essential to grasp the intricacies of each. Fixed-rate loans offer stability and predictability, while variable-rate loans provide flexibility and potential savings. By weighing the benefits and drawbacks of each, you’ll be better equipped to navigate the complex financing landscape and choose the best option for your needs.

A fixed-rate mortgage provides a secure and stable interest rate that remains unchanged throughout the life of the mortgage, typically ranging from 10 to 30 years. This means your monthly mortgage payments will be consistent and predictable, making it easier to budget and plan your finances.

With a fixed-rate mortgage, you’ll enjoy protection from rising interest rates, ensuring your monthly payments won’t increase over time. This financing option is ideal for those who value stability and predictability in their mortgage payments.

A variable-rate mortgage provides an interest rate that can fluctuate over time, typically in response to changes in market conditions, such as economic shifts or central bank decisions. This means your monthly payments can increase or decrease accordingly, offering flexibility in your financing arrangements.

With a variable-rate mortgage, you’ll have the potential to benefit from lower interest rates and reduced payments when market conditions are favorable, allowing you to optimize your financial situation.

Click on the next page button to continue enjoying the article!

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.