Email: [email protected]

Embarking on a journey to find your dream home can be an exhilarating experience, but navigating the complex world of mortgage financing can be daunting. With interest rates fluctuating and mortgage options evolving, understanding your financial limits is crucial to avoiding costly mistakes and ensuring a smooth home buying process.

Without a clear picture of your mortgage capabilities, you risk overextending yourself financially and jeopardizing your long-term stability. A mortgage calculator is a powerful tool that helps you determine your home buying power, allowing you to make informed decisions and avoid financial pitfalls.

In this comprehensive guide, we’ll walk you through the process of using a mortgage calculator, providing expert tips and insights to maximize your home financing options. Whether you’re a first-time homebuyer or a seasoned real estate investor, this article will empower you with the knowledge to confidently navigate the home buying process and secure the best mortgage deals available.

A mortgage calculator is a sophisticated online tool designed to empower homebuyers with accurate estimates of their mortgage affordability. By inputting crucial factors such as:

This cutting-edge calculator provides a comprehensive picture of monthly mortgage payments, enabling informed decisions on mortgage refinancing, home equity loans, and additional financing solutions.

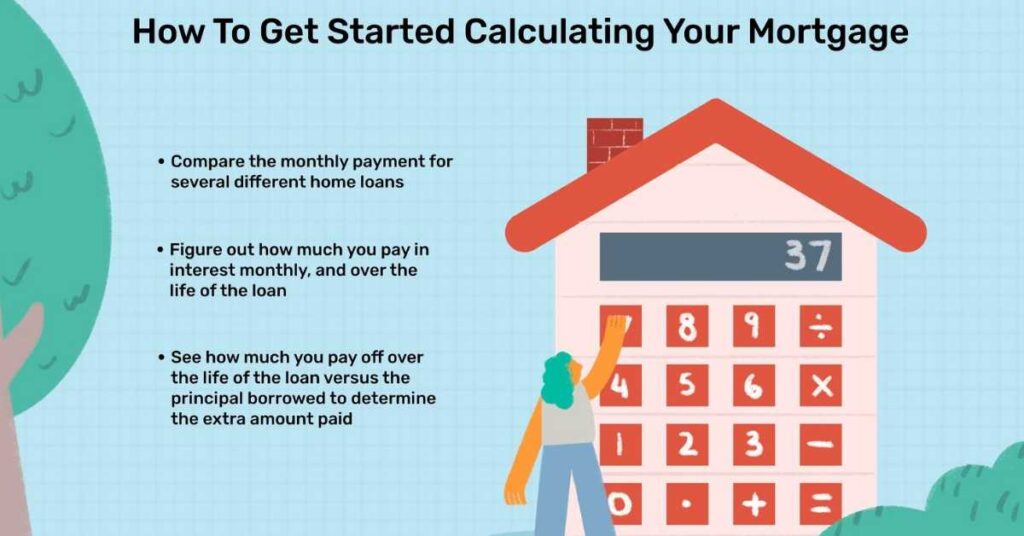

To determine your home buying power, use a mortgage calculator to assess your financial readiness. Follow these steps:

Click on the next page button to continue enjoying the article!

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.